Becoming a homeowner is a rite of passage for most Kiwi’s. Though widely accepted as one of the most secure (and intelligent) forms of investments, securing a place on the New Zealand property ladder doesn’t come cheaply.

Banks are the primary source of lending for people wishing to purchase a home. As a mass market lender, they offer off-the-shelf mortgages designed to suit the masses. It’s important you understand that banks make their money on the interest charged on your mortgage, so the longer your mortgage term, the more interest they make.

On a typical $600,000 mortgage at 4.95%, you’re not only required to repay that initial amount, but approximately $552,000 in additional interest when making monthly repayments over a 30-year term. That’s almost double what you needed to pay for your home in the first place. It doesn’t have to be like this though. It’s possible to repay your mortgage sooner and save thousands of dollars in the process.

There are lots of different ways to pay off your mortgage sooner. For example, you could make small, additional payments every week towards your mortgage. Using our previous example, by simply making an additional $50 per week payment (on top of your existing mortgage repayments), you can pay off your mortgage 4 years earlier and save yourself $83,000 in interest.

Another common strategy is to make fortnightly payments rather than monthly. Using that same example, simply by switching to fortnightly payments, you can pay off your mortgage 5 years earlier and save yourself $100,000 in interest.

Of course, you could do both. By changing to fortnightly payments with an added top-up of $50 per week, you could pay off your mortgage 8 years earlier and save yourself $162,000. That’s a lot of money you could do great things with.

If you’re really serious about being mortgage free, there are clever ways to combine banks’ loan products to turbo-charge your mortgage repayments even further. The point is, just because banks offers 30-year mortgages, doesn’t mean you have to take 30 years to pay it off. You can get it done much quicker and save yourself potentially hundreds of thousands of dollars in the process.

BE MORTGAGE FREE SOONER, RATHER THAN LATER.

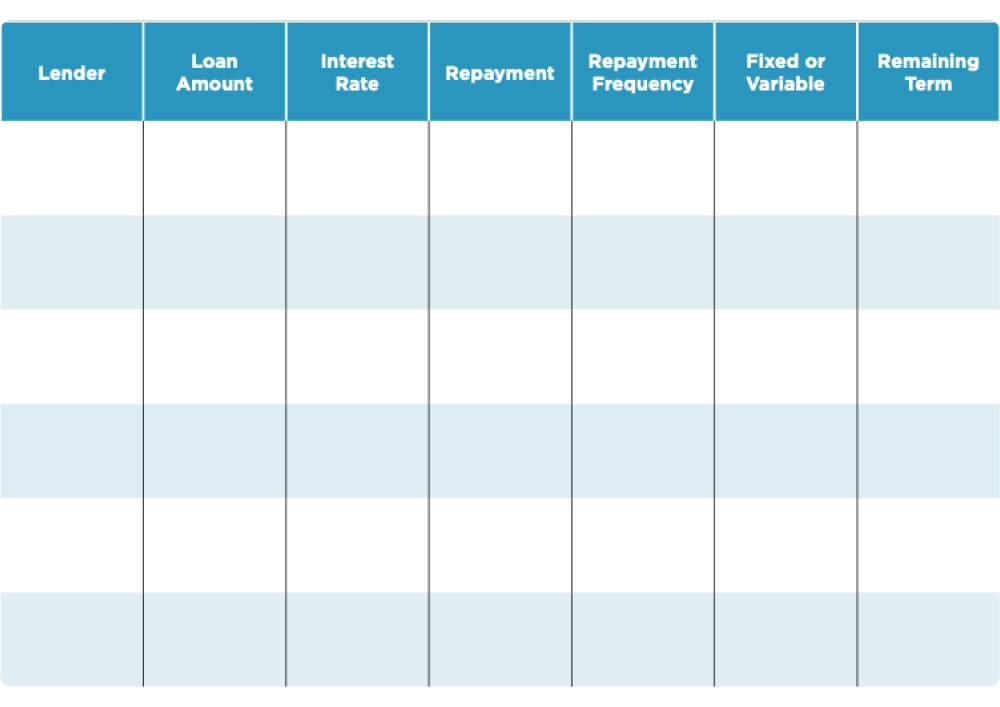

Use the following table to get a visual on all your loans and identify ways to be smart with your money.

If you’re really serious about being mortgage free, there are clever ways to combine banks’ loan products to turbo-charge your mortgage repayments even further. The point is, just because banks offers 30-year mortgages, doesn’t mean you have to take 30 years to pay it off. You can get it done much quicker and save yourself potentially hundreds of thousands of dollars in the process.

Be mortgage free sooner rather than later. Use the following table to get a visual on all your loans and identify ways to be smart with your money.