It is a rather sobering fact that when we look at the population at the age of 65, we find that we can divide these into 2 distinct groups. There is the group which you want to be in, approximately 15% will make it into this group and they are those who reach some form of financial independence by the age of 65. Then there is the remaining 85% of the population who at age of 65 are either dead or dead-broke.

When we discuss the types of people that end up in each group, we find that many will assume the 15% group who reached financial independence is made up of lawyers, Doctors and Accountants. And when we ask about the 85% group the assumption is this group is made up of blue collar workers or people who may have had a lower paid job such as a bus driver etc.

However, the reality is there are Lawyers, Doctors and Accountants in the 85% group and there are blue collar workers and bus drivers in the 15% group. This strongly suggests it isn’t what school or university you attended but more importantly how you applied your finances throughout your working life that determines which group you will end up in.

A surprising reality of the people that make up both of the groups is that they have more in common with each other than you might think. When we look at their lives leading up to retirement. Both groups have similar paying jobs, make similar choices about home ownership, how many children they have, and the list goes on.

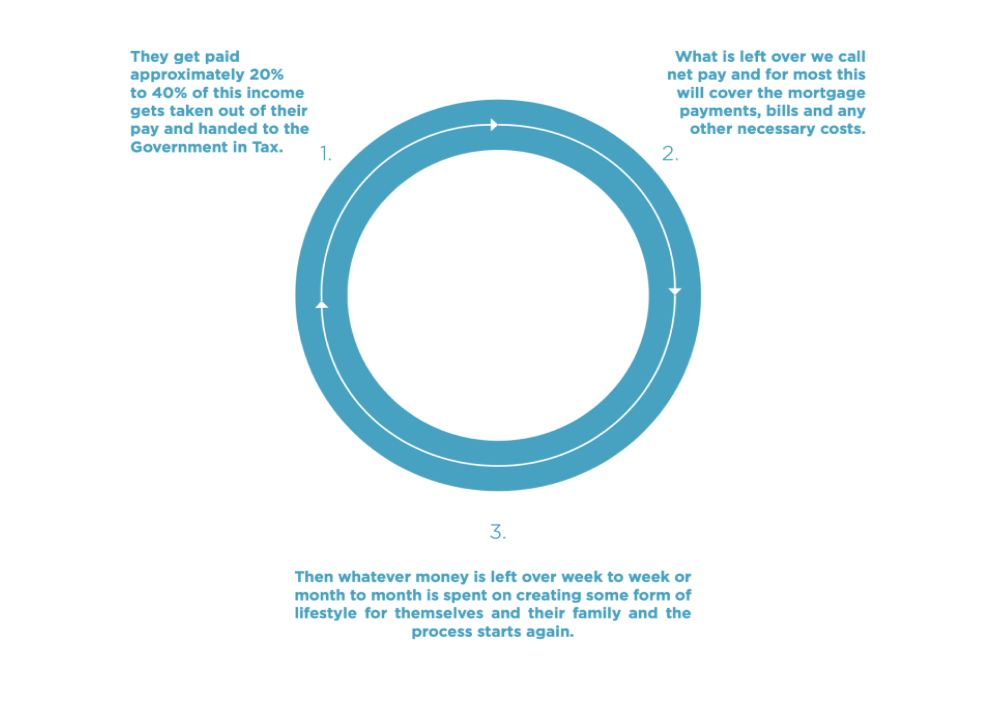

The difference between the two groups will become apparent when we look at the mechanics of the poverty cycle.

For those who are in the poverty cycle the process works like this.

It is our goal to assist those who have reached the realisation that they need a strategy to maximise their ability to develop long term wealth. This Ebook is the first step on your journey to achieving your own personal financial independence.

Our strategies are designed to give you the clarity and confidence to move towards a more secure future whilst enjoying the lifestyle you have now.